Can Singaporeans get NZ mortgage financing?

Singaporeans are eligible to apply for a New Zealand mortgage, subject to qualifying conditions.

Many Singaporean investors are attracted to the New Zealand property market due to its strong rental demand and capital growth potential. For property investors who want to amplify their returns by leveraging sensibly or simply want to get started with a small deposit on investment property, mortgage financing can be a very powerful tool when its made available.

Can Singapore investors get mortgage financing in New Zealand?

This is a question commonly asked by potential Singapore investors in the New Zealand property market. The short answer is yes, it is 100% possible. However, it may be challenging for first-timers who are unfamiliar with navigating the borrowing landscape and to meet the different lending requirements while trying to do it all by himself.

As a Singaporean investor myself who has successfully financed investment properties in New Zealand through a New Zealand mortgage, I am happy to share my experience and knowledge with fellow investors whom many has since followed the same path and successfully secured their own New Zealand mortgage financing. Despite the NZ mortgage process can be a little more tedious than applying for a mortgage in Singapore, the benefits can be well worth the effort. Walking the journey with an experienced fellow Singaporean investor who has gone thru the process, together with a professional loan broker who is an expert in dealing with Singapore applicants, can greatly simplify and accelerate the process. Moreover, it's important to note that every mortgage application is different and evaluated on an individual basis, so there is no one-size-fits-all approach when it comes to mortgage financing in New Zealand.

While limited, there are healthy number of borrowing options for Singaporean investors

Do Singaporeans have access to all NZ lenders?

The first thing to note is that not all New Zealand lenders are willing to consider mortgage applications from Singaporeans as foreign investors. However, there are a healthy number of mainstream and second-tier lenders who are open to providing mortgage financing to Singaporeans. Working with an experienced mortgage broker who has established relationships with these lenders can help investors access the lending landscape and find the best financing options available for their specific investment needs.

How much typically can Singaporeans borrow?

The amount that Singaporeans can borrow in New Zealand largely depends on their individual financial profile and the lender's assessment. Generally, New Zealand lenders will assess a borrower's income and expenses, credit history and the type & size of the property being purchased before determining the maximum amount of financing available.

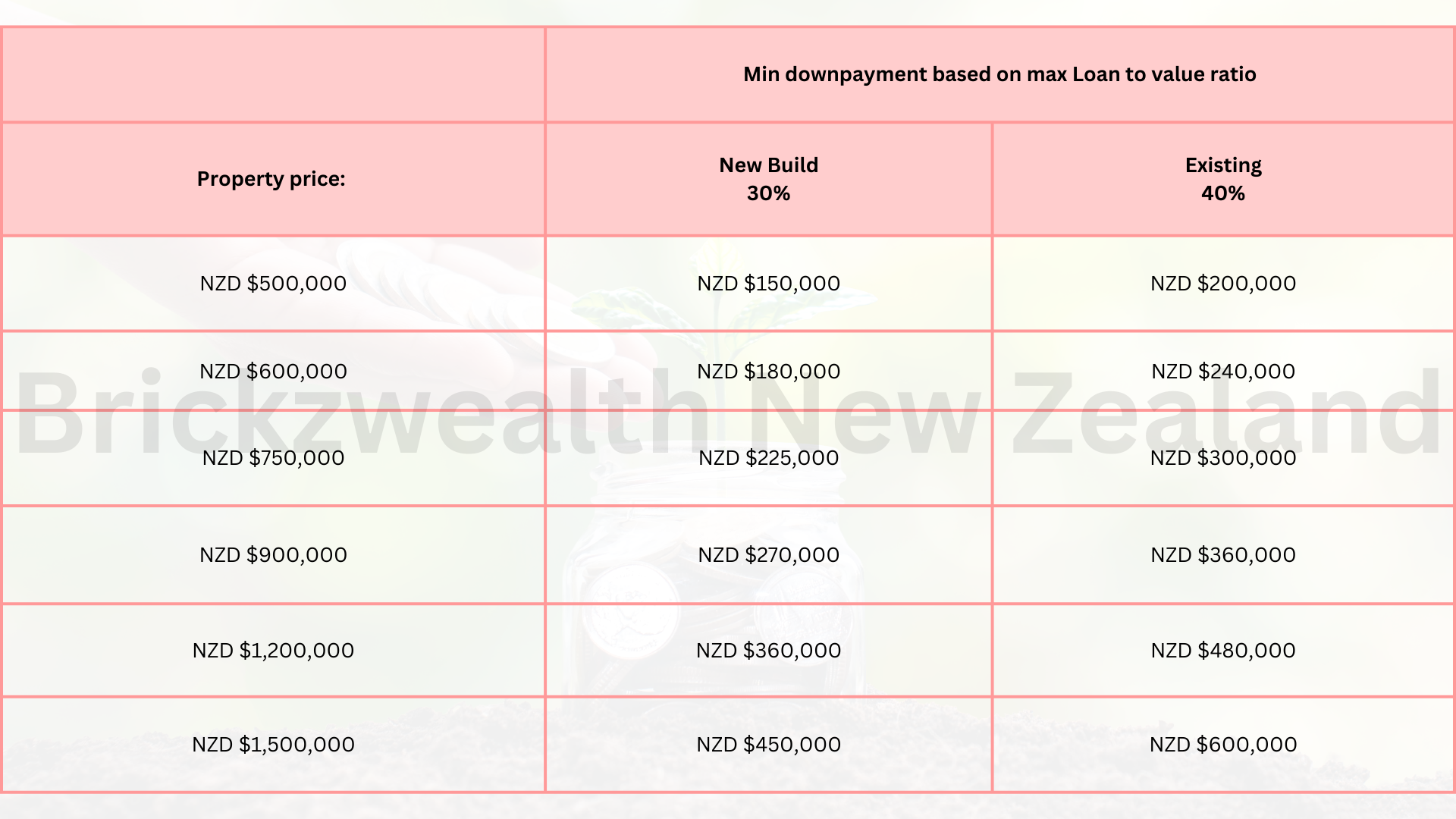

As a guide and based on the current LVR ruling (at the point of writing), the maximum loan-to-value ratio is usually around 70% for new builds, while for resale properties, it is around 60%. The table below then gives you an idea of the required deposit base (or equity) that Singaporeans investors will need to put down based on the maximum borrowing approved by lenders.

Do note that LVR % is usually based on the lower of the purchase price or appraised value of the property, whichever is lower. For example, if your property manage to fetch a valuation of $1million which you only paid $800,000 for, do not be too happy to think that you can borrow more and pay less, as lenders will based the LTR lending % on the $800,000 purchase price since it is the lower of the both.

On the other hand, if your property valuation comes in at $800,000 which you paid $1million for, the LVR lending % will be based on $800,000 and that means you must be prepared to top up the difference in cash to the seller/developer. It is therefore prudent to always factor in buffers when trying to work out the amount you can borrow vs the amount of deposit base you need to put up.

What are the lenders requirements?

While i am not a financial or mortgage advisor and lending requirements may be vastly different from an actual application due to dynamic changes in the market, these are some basics that I have observed over the years. Do reach out to a licensed loan broker for professional advise and if you do not have one, you may contact me here.

Various documents are required to obtain a mortgage from a NZ lender

Some basics to observe during a lender's assessment for a Singaporean application for NZ mortgage loan. These include:

1) Valid Singapore Passports to be held by all applicants involved

Non-Singapore citizen co-owning with a Singapore citizen spouse must have a valid passport from their country of origin and a valid marriage certificate

Australian & NZ citizens residing in Singapore to show proof of their passports respectively

2) Evidence of Income through Singapore's IRAS Notice of Assessment (NOA), bank statements, payslips & tenancy agreement for property income (if any).

Past experiences have also demonstrated that non-Singapore-derived main work income is questionable and may not be considered by lenders. Eg. Singaporean working in Malaysia and getting paid in Malaysian Ringgit.

3) Declaration forms to be filled up by you and your co-applicants (if any) detailing your over the financial situation, such as your assets and expenses.

Are all incomes treated equal?

Income from different sources is usually treated differently across different lenders when it comes to calculating your borrowing ability. For example, the recognition of salaried income, bonuses, business income, dividends and commission/variable income will all vary. Hair cut rates of varying % are likely to be applied to various types of income, to reflect the actual income amount that the lender is comfortable using to calculate your servicing ratios.

A common misconception is that the higher the declared NOA income, the greater the chance of getting loan approval, which in many cases, is not necessarily the case when compared to another applicant who has a much lower NOA amount. This is due to factors such as different haircut treatments on different income sources, an individual's monthly outgoing obligations can differ vastly (high income but also high outgoings), total credit cards limits (regardless of whether used or not used, as limit is seen as a liability on lender's perspective) and the overall profile of the borrower will have an impact on the lender's decision-making process.

Different lenders see your application differently when it comes to approving mortgage financing for Singaporeans. This is where it becomes important to work with a capable loan broker who can help you navigate the different options and requirements. This saves you invaluable time & resources that ensure that you have the best chance of getting approved for an NZ mortgage loan that is suitable for your financial situation.

It is essential to work with a capable and trustworthy mortgage loan broker who understands Singaporean’s application

Working with an incompetent loan broker is disastrous. It can result in not securing the best loan deals and even potentially delaying your property settlements due to issues with obtaining the loan. This may caused you to have a distorted view of the investment experience in New Zealand, leading you to give up early in an attractive markets in the long run. Therefore, it is important to work with someone who has experience in dealing with mortgage financing for Singaporean investors in New Zealand.

In summary, while it may not be straighforward to obtain mortgage financing in New Zealand as a Singaporean investor, it is entirely possible with the help of a capable loan broker and perhaps even some guidance from fellow investors who have walked the journey. With the right guidance and advice, you can secure the best loan deals and start investing in the New Zealand property market.

What’s the best way to find out more? How can i get started?

If you are reading this, you are probably keen to explore and get started on the investment journey in the New Zealand property market.

Perhaps you are unfamiliar with New Zealand or perhaps you already owned property there and looking to scale? Will New Zealand market be a right fit for you and your family? Is this a good time to buy an overseas property, or should you wait and see?

Well, everyone’s situation is different. There is no one size fits all advice. What has worked for someone, may not necessarily work for you.

At Brickzwealth New Zealand, our aim is to bring clarity to your investment decisions with extensive on the ground experience for the overseas market.

Whether you are a first time property investor or a seasoned buyer with a portfolio, we are here to provide an honest and objective view to your investment journey.

We can help you by:

1) Providing Strategic property advice that best fit the outcome you desire

2) Identify & spot investment opportunities that align with your goals

3) Providing access to value-able partners in your investment journey with us

Besides the resources available on this website, the best way to get started is to kick-start a conversation with us today.

Invest differently. Inspire your future.

Ryan Quah

Founder

Brickzwealth New Zealand