How to maximize your property gains without paying capital gains tax on your New Zealand property?

As a Singaporean investing in the New Zealand property market, understanding tax laws is crucial to maximize gains and avoid any potential losses. As you are probably aware by now, New Zealand has no stamp duties imposed on property purchases, making it highly attractive for Singaporean investors to enter the market without the initial tax burden.

Tight on time? Here’s a quick summary:

-

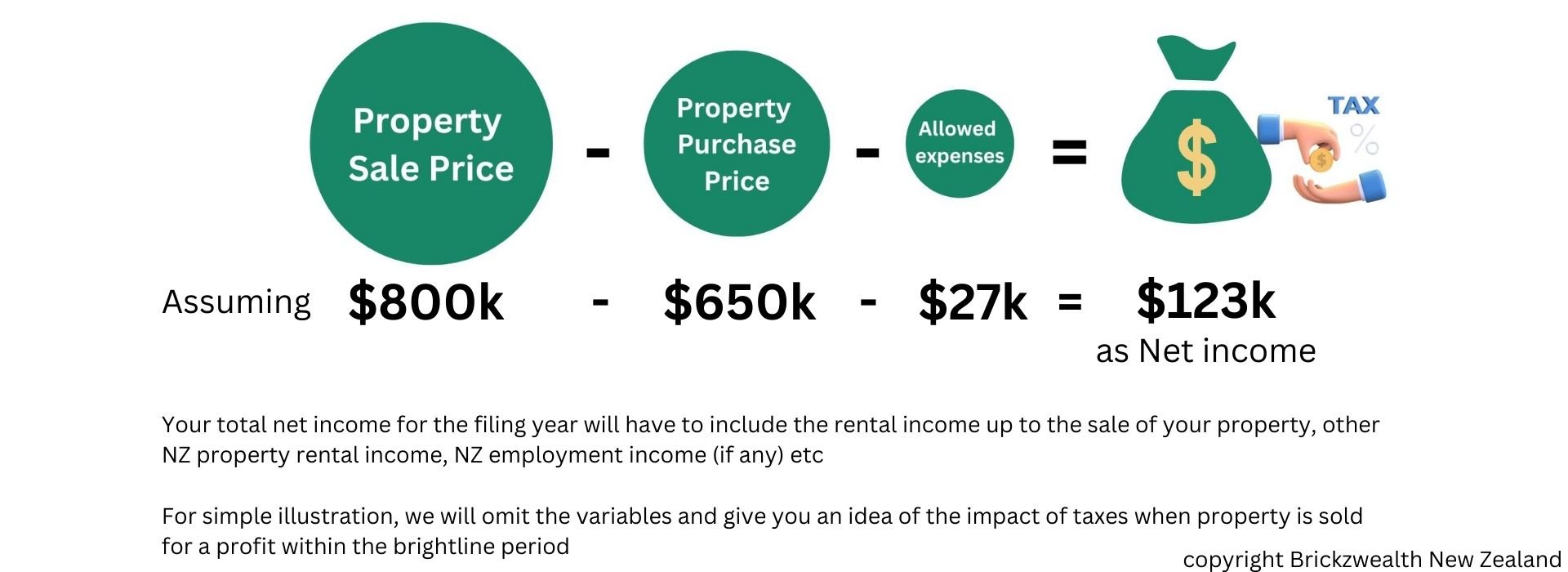

It is a tax on the net profit of your property sale (not the sale proceeds you receive).

Net Profit = Sale price - purchased price - allowed expenses

-

Fortunately, there is no broad capital gains tax rule in New Zealand for property investment. However, Bright-line rule applies where property profits are still taxable if a sale occurred within the said period.

-

5 years for New Builds and 10 years for existing property(resale). Property that is sold out of the period will not be subjected to Brightline tax.

If you sold your New Build property on the 6th year of ownership, you will not be subjected to Bright-line tax (after 5 years).

If it is an existing property instead, your sale would be subjected to Bright-line tax (within 10 years).

-

The rule is aim at curbing short term speculation and keeping the overall market healthy and stable. The government incentivizes New Builds with a shorter period in a bid to increase housing supply as part of an overall plan to solve the housing crisis. The median holding period for property investors that resulted in a net gain on their property sale are between 7-8 years. As such, Investing in New builds would give you an additional advantage.

When we decide to exit, is there a tax payable then?

One of the most significant tax concerns for global property investors is capital gains tax. In this article, we will discuss what capital gains tax is and explain the bright-line rule in New Zealand. Additionally, we will discuss the benefits of investing in new builds with just a five-year period that you should take advantage of as a Singaporean investor.

Capital gains tax is on the property profits, not the sales proceeds you receive

What is Capital Gains Tax?

Capital gains tax is a tax on the profit made from the sale of an asset, such as property or shares. Essentially, an investor's profitability can be adversely affected as he is to pay a portion of his profits from an asset sale to the government. Most Singaporeans may not have come across this or had to deal with such tax when profiting from the sale of assets here because, fortunately, Singapore has no capital gain tax rule. Singaporeans who had invested in the overseas asset are probably aware that the capital gains tax rule can be quite common in many developed countries. Here's a few popular investment destination and their tax treatment on capital gains:

Popular investment destination by Singaporean and their capital gains tax treatment

Fortunately, in New Zealand, there is currently no capital gains tax on residential property, allowing you to maximize your property gains when you exit. However, there are situations when tax may still be imposed on your capital gains. While there is no capital gains tax rule, the NZ government has introduced a bright-line rule to reduce property speculators from avoiding tax on short-term gains.

What is Bright-Line Rule in New Zealand?

The bright-line rule was introduced in 2015 and has undergone several changes since then. It is a tax rule that applies to the sale of residential property that occurs within a specified timeline. Under the current rule, for any property purchase from March 2021, if you sell the residential property within five years (for New builds) or Ten years (for resale) of purchase, you will be subjected to income tax on any profit made from the sale. Loosely interpreted, this can be understood as a time-based capital gains tax rule that applies to residential property sales in New Zealand. If you are thinking that this is similar to the 3-year seller stamp duties (SSD) rule that we have here in Singapore, you are not wrong except that SSD tax on the entire valuation of the property sold (regardless of profitability), while the bright-line rule in NZ only taxes the profits made from the sale (if any).

What are the recent changes?

The bright-line period was initially two years when it first started in 2015, but was later extended to five years by the Labour Government in 2018. And again in 2021, the bright-line period was further extended to ten years for all existing (resale) residential properties, except for new builds. This is on the back of a strong housing market in New Zealand where property prices are rising rapidly due to high demand and limited supply. By keeping the bright line rule the same at 5 years for New Builds, the NZ government is incentivizing the construction of new homes to increase the housing supply while also limiting property speculation. This has and will continue to drive the price momentum of new builds as they become more attractive to buyers and investors alike.

Benefits of Investing in New Builds with Just a Five-Year Period

While these rules are essential to keep the property market healthy with prices rising steadily, forward-looking investors would position themselves in property developments that would maximize their profit potential from the tax angle. One way to maximize your gains without being subjected to the Bright-line rule in NZ is by investing in new builds.

New builds are properties that are newly built and have never been lived in before, and they offer several benefits to investors. One of the significant advantages is the shorter bright-line rule, which is just five years. If you invest in a turnkey property that is still under construction, the effective date of the bright-line starts from the date you purchased the property (unconditional and paid initial deposit), and not from the completion date, which reduces your holding period of a completed property if you intend to sell after the 5-year rule to avoid paying income tax on the profits (if any). As such, investing in new builds not only provides you the flexibility to sell without any capital gain tax after a short 5-year period, but it also provides you the opportunities to ride on the strong price momentum due to increased demand from homeowners and investors. Many investors have seen this as a way to maximize their capital returns when investing in the New Zealand property market.

Another major benefit of investing in New Builds that will maximize your property gains is the ability to deduct the interest cost on your mortgage (if any) against the rental income you receive as an eligible expense. This benefit has been taken away from resale property buyers during the last change in 2021. With the interest deductibility on a New Build, this effectively reduces your net rental income, resulting you in paying lesser rental income tax. With the tax bill saved, it immediately translates into a gain and contributes to your overall profitability. It is worth while to note that this benefit has a 20 years lifespan, from the time the property receives its CCC (similar to TOP in Singapore) and is transferable to future buyers making such New builds an attractive option.

Should I be concerned about the Bright-line rule?

While the bright-line rule may seem to be a rule introduced to penalize property investors, it can work in the favor of long term investors instead. This reduces volatility in the market and ensures sustainable growth in the property market over time, rewarding investors thru the cycles.

If you are someone looking to make a quick investment sale gain in 1-3 years or lesser, investing in the New Zealand property market may not necessarily be the right fit for you. On top of the bright-line rule that can be a potential tax liability on a short term gain, it takes time for property prices to grow thru the natural cycles in the market.

If you are a long term investor looking for steady capital growth and passive income from your investment, the New Zealand property market can be an excellent vehicle for wealth creation. As such, the bright line shouldn't affect you too much but instead, ensure the stability of your investment for it to rise steadily.

If you invested in NZ property with the intention for long-term growth, but had to sell the property within the brightline rule period due to an unforeseen need to raise cash, what would that be like?

Assuming you incurred a slight loss on the property sale, because there is no profit, there would be no need to pay any income tax on the sale under the bright-line rule (tax on rental income received up to the sale still applies). Unlike in Singapore, where seller stamp duties would still apply on the entire property valuation (if sold within the 3 year period), even if the property recorded a negative sale, further deepening the overall loses.

On the flip side, if you manage to net a profit on the property sale, or perhaps you had an opportunity to sell the property at a good price during the bright-line period, is it still worth it?

Basing on this simple illustration (excluding other income and expenses), seller would have been pay the tax department $31,510 out of a net profit of $123,000, for the sale of his investment property within the Bright-line period of 5 years for new builds and 10 years for existing property. That’s approximately 25% of his net profits, a chunky amount that reduces his overall ROI but still gave the investor decent profits. To maximize profitability without being subjected to capital gains tax, the most ideal scenario is to exit the property investment out of the Bright-line period, in conjunction with the right market conditions. According to a report by core-logic, the median holding period for property investors who resulted in a net gain on their property sale is between 7-8 years. The much shorter Bright-line period for New Builds at 5 years (vs 10 years for existing properties), had drawn many investors into this space as it provides them the flexibility to exit without the tax burden when the market conditions are right for them to sell.

In conclusion, you will see why the New Zealand is fast becoming a popular destination with Singaporean investors seeking long-term capital growth and passive income from their property investments. When compared to several global options, New Zealand does offers an attractive mix of economic stability, political security, and a robust property market with steady growth potential and of course, its friendly tax policies for Singaporean investors. Understanding the boundaries allows us to position our investments accordingly and maximize our gains in the long run.

What’s the best way to find out more? How can i get started?

If you are reading this, you are probably keen to explore and get started on the investment journey in the New Zealand property market.

Perhaps you are unfamiliar with New Zealand or perhaps you already owned property there and looking to scale? Will New Zealand market be a right fit for you and your family? Is this a good time to buy an overseas property, or should you wait and see?

Well, everyone’s situation is different. There is no one size fits all advice. What has worked for someone, may not necessarily work for you.

At Brickzwealth New Zealand, our aim is to bring clarity to your investment decisions with extensive on the ground experience for the overseas market.

Whether you are a first time property investor or a seasoned buyer with a portfolio, we are here to provide an honest and objective view to your investment journey.

We can help you by:

1) Providing Strategic property advice that best fit the outcome you desire

2) Identify & spot investment opportunities that align with your goals

3) Providing access to value-able partners in your investment journey with us

Besides the resources available on this website, the best way to get started is to kick-start a conversation with us today.

Invest differently. Inspire your future.

Ryan Quah

Founder

Brickzwealth New Zealand