How to minimize your rental income tax to maximize your overall ROI?

Rental income received will be taxed as a form of personal income

What is the tax treatment on rental income earned by Singaporean investors from New Zealand rental properties?

If you have been reading my other articles on taxation matters for investing in New Zealand property market as a foreigner / Singaporean, you will quickly realize it largely favors property investors with its friendly tax policies. They range from 1) no stamp duties on property purchases, 2) no additional buyers stamp duties (ABSD) as you build multiple property portfolios here, 3) no capital gains tax (CGT)* to 4) no inheritance tax. Compared to Singapore and many other popular investment destinations, such friendly policies does give property investors many advantages. If you haven't read them, please be sure to check them out here.

What about rental income tax?

For most Singaporeans, we have the impression that many Western countries including New Zealand have high-income tax rates than what we have here, which therefore may significantly reduce a person's net take-home income. While that may be true for employment income, things are a little different for property income for Singapore property investor.

One common question that I always get asked is whether the tax on rental income in New Zealand will then be a significant expense. In this article, we will explore this topic and shed some light on what to expect when investing in New Zealand property as a foreign investor.

Where does rental income falls under?

Firstly, let's clarify what tax on rental income is. In New Zealand, rental income is taxed as a form of personal income, with the tax rate depending on your overall income. This means that if you earn rental income, you will need to declare it on your NZ tax return, and it will be taxed accordingly. Similarly here in Singapore, any rental income earned from your Singapore investment property, together with your employment and other sources of income is subjected to personal income tax as a whole.

Fortunately, for most Singaporean investors, the rental incomes we received from our New Zealand properties are likely to be the only source of income we receive in the country since most of us reside here in Singapore and do not have any other source of employment/business income in New Zealand. Since New Zealand uses a progressive tax system just like Singapore (we will discuss this shortly below), this may put us in a favorable position to qualify for lower tax tier rates depending on your total portfolio rental income received in New Zealand.

Do I need to file my NZ rental income in Singapore?

Fortunately, New Zealand has a double taxation agreement (DTA) with Singapore which provides immense benefits. In short, this agreement ensures that we do not get taxed twice on the same source of income. This means that as a Singaporean property investor, you do not have to pay taxes twice on your rental income earned from your New Zealand property. Instead, we only need to apply for an IRD (Inland revenue department) account in New Zealand and declare & file our rental income there. Therefore, there is no need to declare your NZ property rental income in Singapore in this instance.

How much do I have to pay on my rental income?

Before we go into the actual tax rates, the beautiful thing about investing in rental properties is that there are deductions allowed for expenses such as council rates, maintenance, repairs, property management fees, property insurance, mortgage interest (only for New builds from 2021) and many others. In other words, the income tax rates will only be applied to the net rental income (Gross rental income minus allowed expenses) or commonly known as assess-able income. Below is a screenshot of the allowed deductions against your rental income from your New Zealand property:

For more information from IRD website on the allowable expenses, click here

What are New Zealand Income Tax rates?

Similar to Singapore, New Zealand also employs a progressive tax system where the tax rate increases on your incremental income according to the tier amount. In other words, your total net income may be broken up into different portions and varying tax rates will be applied to each portion. Below are the most recent updated New Zealand income tax rate:

For latest update from IRD website on the income tax rates, click here

Since our NZ rental income is likely to be the only source of income in the country, together with the list of allowed deductions as expenses, this puts us in a favorable position to qualify for lower tax tier rates. In most cases, the tax bill on rental income is not a significant expense that will greatly reduce our overall profitability which makes it an attractive option for Singaporeans to invest in New Zealand rental properties.

How to maximize your ROI by minimizing your rental income tax payable?

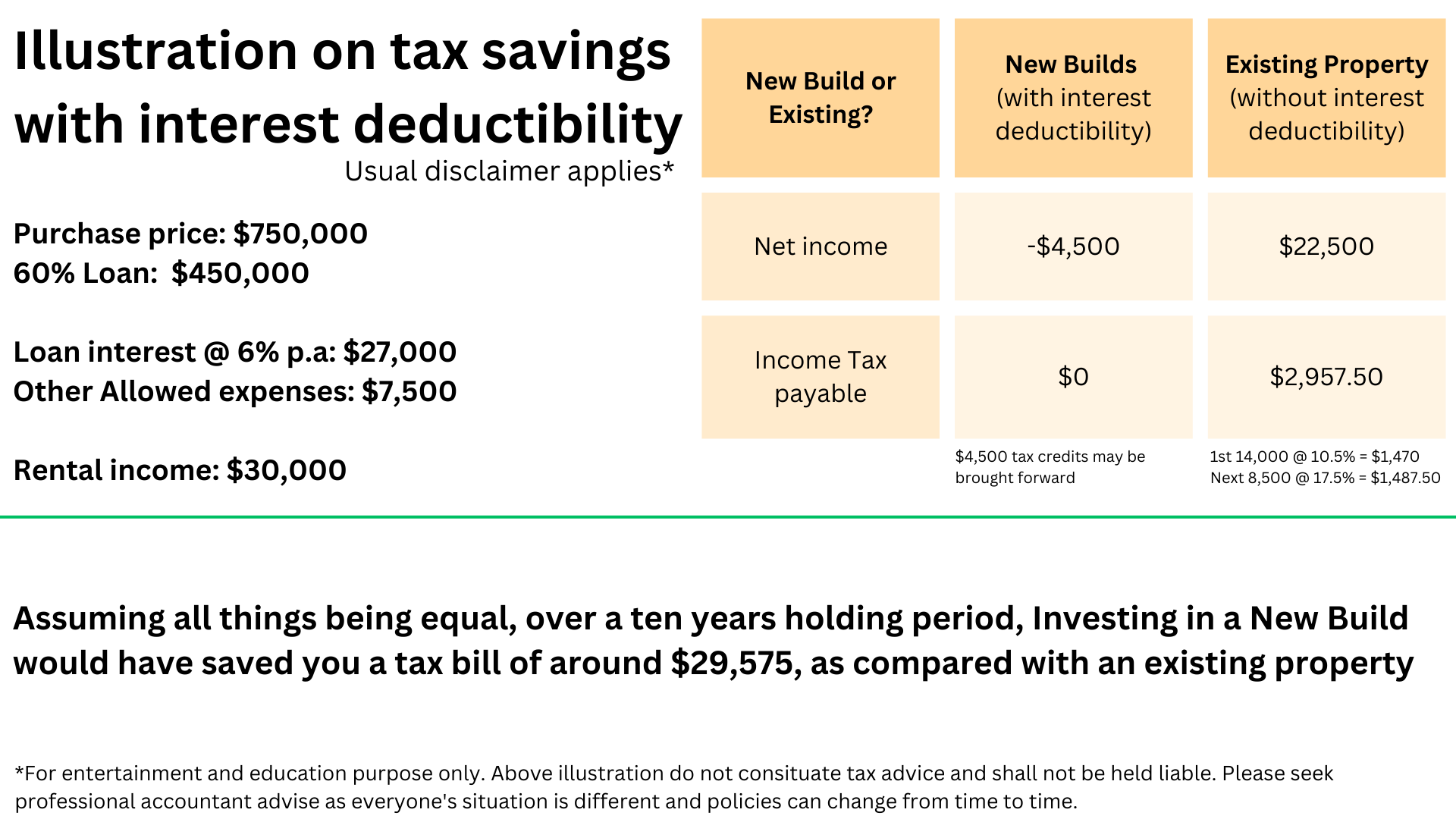

Investing in New Builds can offer property investors significant tax savings over the entire investment horizon. This is due to a recent policy implementation in 2021 that no longer allows property investors from filing mortgage interests as an allowed deductible expense. This will dramatically increase the tax bill for alot of property investors, since mortgage interests (cost of borrowing/interests paid to your lender, principal repayment excluding) usually form the largest expense on their tax filing. However, New Builds are exempted from this policy change and interest costs is eligible to be deducted (against your rental income) for up to 20 years from the time the property's code compliance certificate is issued (similar to our T.O.P in SG). In addition, the interest deductibility benefit applies to all future resale owners and allows them to enjoy the same interest deductibility, up to the remaining lifespan left on the 20 years period. For simple illustration for an example, if you sold your new build property on the 6th year, your new resale buyer will have another 14 years to enjoy the same interest deductibility. On top of other benefits of investing in a New build, the new interest deductibility rule has increasingly drawn investors over to this segment, further creating upwards price momentum for long term new build investors.

What are the tax savings be like?

Why diversify into New Zealand property from an income tax perspective?

Obviously, as you read thru the website, you will find that there are a whole lot of benefits to investing in the New Zealand property market for Singaporeans. From the income tax perspective, besides income tax payable on your NZ property being an insignificant expense most of the time, it may further benefit certain groups of Singapore investors whose net income is already at the highest bracket and may want to consider diversifying any rental income stream from overseas (such as New Zealand) to minimize your tax liabilities. For example, in New Zealand's case, your rental income from a NZ property is likely to be treated independently of your Singapore income (depending on your tax residency), which means you will only have to pay tax on your net rental income at the applicable New Zealand tax rate. This is the case for many of the investors whom i have worked with and who are Singapore Tax residents,and they have found that diversifying into New Zealand property has allowed them to optimize their tax positions and increase profitability.

What’s the best way to find out more? How can i get started?

If you are reading this, you are probably keen to explore and get started on the investment journey in the New Zealand property market.

Perhaps you are unfamiliar with New Zealand or perhaps you already owned property there and looking to scale? Will New Zealand market be a right fit for you and your family? Is this a good time to buy an overseas property, or should you wait and see?

Well, everyone’s situation is different. There is no one size fits all advice. What has worked for someone, may not necessarily work for you.

At Brickzwealth New Zealand, our aim is to bring clarity to your investment decisions with extensive on the ground experience for the overseas market.

Whether you are a first time property investor or a seasoned buyer with a portfolio, we are here to provide an honest and objective view to your investment journey.

We can help you by:

1) Providing Strategic property advice that best fit the outcome you desire

2) Identify & spot investment opportunities that align with your goals

3) Providing access to value-able partners in your investment journey with us

Besides the resources available on this website, the best way to get started is to kick-start a conversation with us today.

Invest differently. Inspire your future.

Ryan Quah

Founder

Brickzwealth New Zealand