Why does understanding inheritance tax matter to your overseas property?

Are you willing to let the tax man take a significant portion of your legacy away from your loved ones?

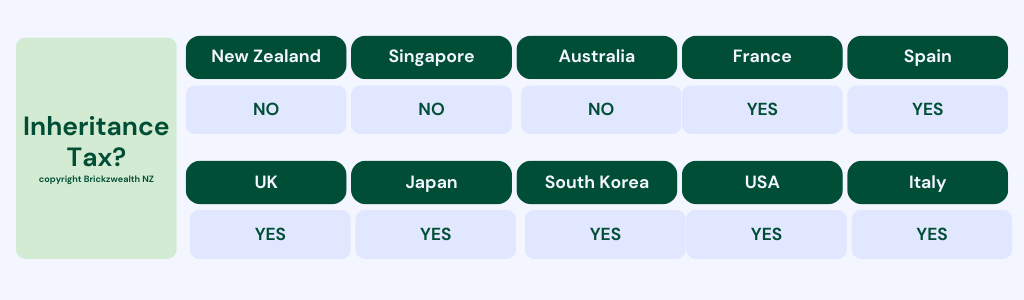

Inheritance tax is often a forgotten component when it comes to property investment since most Singaporeans do not have to deal with such tax treatment for local properties here (at point of writing). However, when venturing abroad to overseas markets, this is a crucial consideration for investors who are looking to build and preserve property wealth as different countries can vastly differ in inheritance tax treatment. In many countries, including some of the most developed ones, inheritance tax can cause significant wealth leakages when passing on a property to loved ones.

Which countries are inheritance tax law appliceable?

Tight on time? Here’s a quick summary:

-

Inheritance tax is a tax on the transfer of assets from a deceased person to their heirs or beneficiaries. The purpose of inheritance tax is to generate revenue for the government and to prevent the concentration of wealth in the hands of a few individuals.

-

Inheritance tax is typically paid by the beneficiary of the inheritance and the amount of tax owed is based on the value of the assets received.

-

1) Reduced value of inheritance

2) Complicated tax process

3) Costly tax bill can call for the unexpected need to raise cash urgently

-

Fortunately, there is no inheritance tax in New Zealand.

-

Prevent wealth leakages with the ability to pass down an asset in its full value without inhertiance tax obliagtions. Keep process simple without the need to raise funds to pay any tax bill

What is an inheritance tax?

An inheritance tax is a tax imposed on the transfer of assets after an individual's death. This transfer of assets can include real estate properties, investment portfolios or any other form of inheritance that is passed on to the beneficiary. Whether your portfolio consists of 1 property or multiple properties, the effects of inheritance tax should not be overlooked. In most cases, the hefty tax must be paid before the property asset could be handed over to your intended beneficiaries. This potentially poses a multitude of problems to your loved ones which we will discuss shortly below.

Who does it affect?

While we may think that this only affects investors who plan to pass on their properties to the next generation, it can similarly impact an investor's portfolio (who may even have an exit sell strategy in place) as an unfortunate passing can happen to anyone suddenly, God forbids. We do not want our loved ones to be caught in an inheritance tax bill situation, during a sudden demise, leaving behind a pool of overseas property assets. Inheritance tax rates can vary greatly depending on the country and region, but in some cases, they can be as high as 40% of the total value of the inheritance. For Singapore investors with overseas properties, inheritance tax matters since the taxes can significantly decrease the value of their estates when they pass them on to heirs. Let's take a look at the presence of inheritance tax across several popular investment destination:

How does it affect you & your loved ones?

It can be an overwhelming and daunting task for family members to deal with estate taxes, moreover for overseas properties of a foreign jurisdiction. For many, investing in physical property is a way to pass on their legacy to the next generation, but failing to properly consider the potential inheritance tax implications of overseas property can mean that a significant portion of this legacy is lost. Here's how it can affect you and your loved ones:

Is there an inheritance tax wall between your assets and your loved ones?

1) Reduced value of inheritance: The hefty inheritance tax can significantly reduce the value of your inherited property, leading to a significant loss in wealth for your intended

How would you feel if the legacy you worked so hard to build for your loved ones was significantly reduced due to inheritance tax?

2) Complicated tax processes: Estate taxes for overseas properties can be particularly complicated and time-consuming, and dealing with them may cause confusion, stress and headaches that could have been avoided

Can you imagine the emotional distress your loved ones have to go through dealing estate tax issues with the authorities just to receive your property gift?

3) Costly tax bills can call for the unexpected need to raise cash quickly: This could potentially put a big strain on beneficiaries' cash liquidity and often if the cash cannot be raised, it may lead to a sale of the property assets at a timing when market conditions are less idea or worst.

What would you do if your loved ones were forced to sell off assets to pay for the inheritance tax on your property gift?

What's New Zealand's Inheritance tax position?

New Zealand has a unique tax treatment on property inheritance, making it an attractive option for investors looking to preserve their wealth and pass it on to their loved ones without incurring significant tax burdens. New Zealand is one of the few countries in the developed world that does not have Inheritance tax, allowing investors to pass on a property of its full value to their loved ones upon their demise. This allows beneficiaries to enjoy the benefits of the property without any tax implications to receive the property asset, protecting it against any wealth leakages or the need to deal with unexpected cash needs. This makes New Zealand property a great vehicle for generating wealth and preserving it for future generations.

New Zealand has no inheritance tax law

In conclusion, inheritance tax is an important consideration for property investors beyond just looking at growth potential. If you are looking for a property market that offers not just high growth potential, but also a friendly tax regime that rings fence your wealth against costly inheritance tax, New Zealand is a great option to start building your property portfolio.

What’s the best way to find out more? How can I get started?

If you are reading this, you are probably keen to explore and get started on the investment journey in the New Zealand property market.

Perhaps you are unfamiliar with New Zealand or perhaps you already owned property there and looking to scale? Will New Zealand market be a right fit for you and your family? Is this a good time to buy an overseas property, or should you wait and see?

Well, everyone’s situation is different. There is no one size fits all advice. What has worked for someone, may not necessarily work for you.

At Brickzwealth New Zealand, our aim is to bring clarity to your investment decisions with extensive on the ground experience for the overseas market.

Whether you are a first time property investor or a seasoned buyer with a portfolio, we are here to provide an honest and objective view to your investment journey.

We can help you by:

1) Providing Strategic property advice that best fit the outcome you desire

2) Identify & spot investment opportunities that align with your goals

3) Providing access to value-able partners in your investment journey with us

Besides the resources available on this website, the best way to get started is to kick-start a conversation with us today.

Invest differently. Inspire your future.

Ryan Quah

Founder

Brickzwealth New Zealand